Nowadays, there are no payment systems that do not use blockchain in their technology. Central and commercial banks are interested in blockchain technology and apply it in transfers. Why is this solution so effective? Check out five advantages of blockchain!

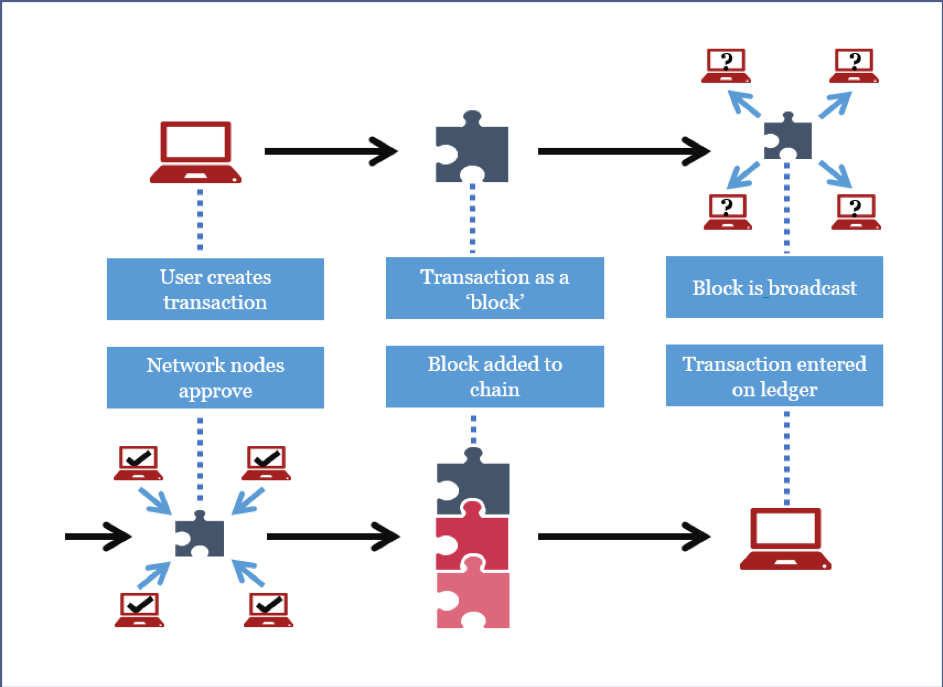

A blockchain is a modern form of database building, that stores information about transactions, authenticity, and correctness of the process. The system contains all information regarding blockchain. You cannot modify them and delete them. Information entered once duplicates, and the database is stored in numerous copies on all devices in a given network.

Five advantages of blockchain

Fewer intermediaries

The payment services industry is huge. Most payment transactions take place through several significant players who are not in a hurry to make improvements. Therefore, a lot of intermediaries participate in the payment process: buyer – payment gateway – exchange system – bank of the cardholder. Brokers store information about the transfer of money, terms of their activities, charge for the process, and extend it, making it less secure. Blockchain can confirm integrity without the presence of intermediaries. Together with the buyer, sellers transfer money with peer-to-peer payment, and the system saves data on the subject. As a result, the transfer process is short, transparent, cheap, and straightforward.

Fast transactions

Although private sector transactions are quite fast, we can’t say it about cross-national transactions. This process often takes several days, due to the need for cooperating with intermediaries to minimize an occurrence of fraud. Transactions involving blockchain allow cashing flow in a maximum few hours. Furthermore, operations do not require any intermediary, and at the same time, it is 100% safe.

Lower costs

The cost of bank transactions in a specific country is up to 3% of its size. In the case of payment transactions, it is up to 0.5%, cross-border – up to 10%. In the blockchain payment system number of intermediaries is very low. Transaction costs decreased to a maximum of 0.1 of its size.

Anonymity

If the system does not have adequate protection, users’ data may fall to an unauthorized person. Moreover, governments use also private information to track citizens. Blockchain technology can introduce a sense of anonymity and security. Also, the system does not need a third party to confirm and verify transactions.

Security level

Not so long ago, in 2016, there was a break-in to Central Bank accounts in Bangladesh. This history confirms that even heavily protected systems can break. This situation influenced the decline of confidence in bank institutions. The blockchain-based platform can help banks to protect transaction information and works quickly – hackers would have less time to act. Each transaction entry is fixed, and its copy goes to each user of the network. Also, blockchain secures two keys – open and private, which is necessary for the transaction. The user account number is associated with the key. Moreover, you can use it only once. It protects against unauthorized transactions.

If you want to know something more about blockchain and cryptocurrency – check out Blockchain in Know Your Customer technology or another of our articles.